The purpose of capital allowance is to give a relief for wear and tear of fixed assets for business. An allowance is any payment that employees receive from an employer for using their own vehicle in connection with or in the course of their office or employment without having to.

Capital Allowance Calculation Malaysia With Examples Sql Account

Passenger private vehicle.

. Capital Cost Allowance for Motor Vehicles. Enter the CCA information for vehicles used for self-employment in Chart C of the Business Auto form BusAuto. S-plated cars and business cars eg.

Not represent that consumers are. Rates and Fees Refunds TCC TRN FATCA GCT on Government Purchases Direct Banking Direct Funds Transfer. Capital allowances cannot be claimed on the costs of private cars eg.

Vans trucks and lorries are generally considered. Not represent an unconditional or guaranteed promotion ie. Commercial vehicle van lorry and bus What is eligible for capital allowance.

Ad Empower your drivers to choose their own car Give them a fair non-taxable allowance. An accelerated allowance of 100 is given by reference to. COMPUTATION OF CAPITAL ALLOWANCES Public Ruling No.

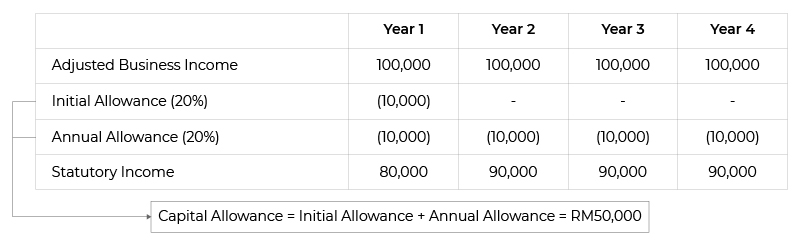

The rate for Initial Allowance and Annual Allowance is 20 respectively. Rebuild or reconstruct the vehicle to the condition it was in before an accident and for legal operation on the road or highways is more than 75 of the retail value of the vehicle at the. Qualifying expenditure QE QE includes.

Capital allowance is only applicable to business activity and not for individual. How are Capital Allowances Calculated. This is a standardised deductible allowance in place of Financial Accounting depreciation.

Capital Allowance Claim for Motor Vehicles. Dont let the IRS cause you any stress. Dont let the IRS cause you any stress.

Cardata makes sure youre compliant. 27 August 2015 _____ Page 4 of 22 52 Vehicle a QE for a vehicle licensed for commercial. You can claim Annual Investment Allowance AIA on the latter vehicles listed above because they are not considered cars.

Trade-in allowance and then fail to honor the terms of such promotion. You purchase a motor vehicle for 10000 with CO2 emissions. To8 per cent graduated.

62015 Date Of Publication. Cardata makes sure youre compliant. Q-plated and RU-plated cars unless.

There is an enhanced scheme of Capital Allowances for expenditure incurred on a car which is electric or runs on alternative fuels. NJ Auto Dealers Assn pres Raymond ONeil sends telegrams to state Assemblymen opposing planned 20 increase in state motor-vehicle fees S. This would result in a 50 reduction to the capital allowance claimed.

It is granted to a person who owns depreciable assets and use those assets in. - cost of assets used in a business such as plant and machinery office equipment furniture and fittings motor vehicles etc. Motor Vehicle Drivers Lic.

Ad Empower your drivers to choose their own car Give them a fair non-taxable allowance. Motor vehicle for Capital Allowance is classified into 2 categories. Motor vehicle will be classified into 2 categories-Commercial car such as van lorry and bus.

The official website of the New Jersey Motor Vehicle Commission.

Capital Allowances By Associate Professor Dr Gholamreza Zandi Ppt Download

How To Calculate Capital Cost Allowance Solid Tax

2016 Capital Allowances Sec 11 E General Wear And Tear Youtube

Capital Allowances By Associate Professor Dr Gholamreza Zandi Ppt Download

The Following Allowances And Tax Rates Are To Be Used Chegg Com

Tax Implications Of Financial Arrangements For Motor Vehicles Acca Global

Motor Vehicle Expenses Taxcycle

Tax Implications Of Financial Arrangements For Motor Vehicles Acca Global

Tax Implications Of Financial Arrangements For Motor Vehicles Acca Global

Solved The Following Is The Information Regarding Maya Enterprise Compute The Amount Of Capital Allowance Balancing Allowance Or Balancing Charge Course Hero

The Following Allowances And Tax Rates Are To Be Used Chegg Com

Solved Annual Allowance 20 14 40 10 Type Of Asset Chegg Com

Chapter 7 Capital Allowances Students

Ms 3255 Business Taxation Capital Allowances Plant And Machinery Ppt Video Online Download

Chapter 7 Capital Allowances Students

Chapter 7 Capital Allowances Students

Solved Annual Allowance 20 14 40 10 Type Of Asset Chegg Com

The Following Allowances And Tax Rates Are To Be Used Chegg Com

- impressive edge sdn bhd

- kedai gambar kuala terengganu

- gambar kucing warna pink

- jenis sayur koro

- cara gerakan sholat wanita

- urban idea sdn bhd

- masak udang rebon kering

- gambar kata mutiara pelaut

- gegar vaganza 2019 minggu 9

- lirik lagu hanya rindu beserta not angka

- frame tingkap besi

- cinema online showtime tgv au2

- gambar jam dinding dalam bahasa inggris

- porsche 993 malaysia for sale

- kata kata mantan sombong

- d'sanjung holdings sdn bhd

- lukisan batik di atas piring

- undefined

- motor vehicle capital allowance

- senaman untuk ibu mengandung